That I would "do school" all year long.

I was going to be Super Teacher in this house, yes sir.

But...I wasn't.

Sitting out on the porch watching my kids ride their bikes was an irresistible attraction.

Watching them run through the sprinklers was irresistible, too.

Then I got started on my new blog project.

Eventually, I just gave up!

The positive side is, now I have an official start to the 2013-2014 homeschool year.

And all of you get a post.

1st Grade Plans

History

- Connecting With History, Vol. 1 (Ancient History)

We actually did the first unit last spring. It is excellent. I am really pleased with their curriculum.

We're just finishing up Unit 2 now. Each one takes about four weeks, depending on how in-depth you choose to go (extra reading, crafts, presentations, etc).

What I personally enjoy about the curriculum is that it covers a broad base of subjects. We're not only learning history; we're also doing geography, literature, language, social studies and religion.

What I personally enjoy about the curriculum is that it covers a broad base of subjects. We're not only learning history; we're also doing geography, literature, language, social studies and religion.

I purchased the Daily Lesson Plans, which recommend what I should do each day to cover all the material. I don't think I could do this program well without them!

They are a huge time and sanity saver.

They are a huge time and sanity saver.

The core books for our history program are the New Catholic Picture Bible , Founders of Freedom, and Usborne's Time Traveler.

, Founders of Freedom, and Usborne's Time Traveler.

Most of the other books we use I am able to check out from our local library as needed.

Most of the other books we use I am able to check out from our local library as needed.

Math

- Math Mammoth (Grade 1)

I decided on Math Mammoth because of the excellent reviews and affordability. I also liked that it is mastery-oriented and requires little prep on my part.

My daughter started the workbook last spring and has taken off with her math skills.

I use beans and an abacus as our manipulatives.

as our manipulatives.

I use beans and an abacus

Reading and Language Arts

- The Ordinary Parent's Guide to Teaching Reading

- First Language Lessons for the Well-Trained Mind: Level 1 (Second Edition)

My daughter is halfway through TOPGTR, but is still resistant to reading. My only real "must do" goal for the end of first grade is to get her reading confidently on her own.

Having only done a few of the lessons out of FLL, I can't comment on how well I like it. One conflict I've already seen is that it has the student memorize many poems and passages throughout the year, while our history curriculum also has similar memorization built in to their program.

For now we are only doing that which is recommended in Connecting With History. If my daughter appears she can do more, we will add in those from FLL.

Religion

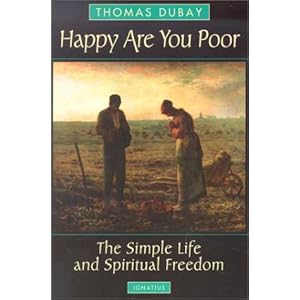

It will be a year before my daughter will officially enter First Communion prep, but this little catechism is so perfect for teaching even little Catholics!

We've went through the book last year, but I am doing it again this year. As children mature they pick up on more concepts.

The illustrations are a big help in facilitating understanding!

We'll also be reading these frequently:

And my absolute favorite little books (lucky library sale find):

We have a pretty healthy collection of faith-based videos for "Mommy Break Time." These are a few:

My (lofty) goal is to get them to a daily Mass at least once a week as well. It terrifies me, but I know I'll get over it eventually.

Handwriting

- Writing with Phonics, K5 Cursive (Abeka)

- Kindergarten Writing Tablet, Cursive

- Numbers Writing Tablet, K

We started these last spring, too. They make learning the cursive letters simple, and to me they were the prettiest script.

Some parents choose not to introduce cursive until 2nd grade, or not at all. My own personal preference is that my children do learn to write neatly and beautifully. It's not one of those "must have" skills, especially in today's computer age where everything is done on a keypad -- but I still believe there is value to learning something that is attractive and requires detailed control.

When to introduce cursive is ultimately dependent on the coordination (and willingness) of the child. My daughter was definitely ready at age 5. My son, who is 4 1/2, will probably not be ready until he is 7.

Supplements

The above forms the core of our first grade curriculum. However, as supplements I am doing the following:

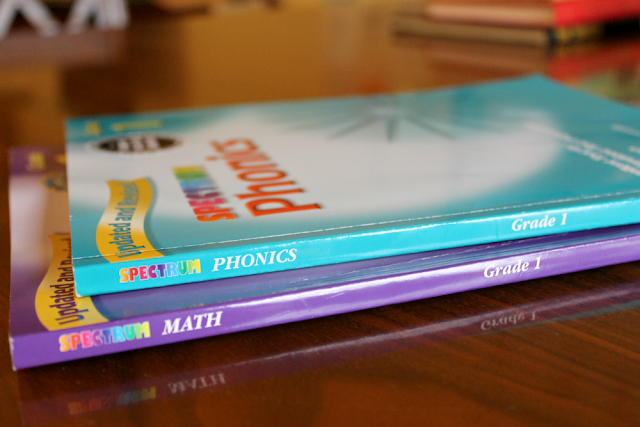

I seriously love the Spectrum workbooks. They are fun for the kids and give me a good benchmark for what they "should" be proficient in by the end of the year (as compared to national standards).

I use them as a free-time activity. ("Oh you're bored? Here, do this! Yay!")

I wouldn't recommend them as a stand-alone teaching resource. They're definitely more for reviewing concepts or giving kids extra practice in their studies.

For art and drawing, I rely on library books such as the one pictured above.

I also bought a lot of bottles of inexpensive acrylic paint from the craft & hobby store, and we have painting once a week. I show my children famous paintings and point out the techniques used (my dear friend here who homeschools taught me to do this!), then they paint their own using similar techniques. Or, for example, we look at a book on autumn leaves and their changing colors, talk about why it happens, then they paint their own leaves.

It's very basic and the emphasis is on enjoyment.

I wasn't going to introduce Latin until 3rd grade, but then I found this Prima Latina cd at a garage sale. Geared for the lower grades (1-3), it is a really nice, easy introduction to Latin and prayers such as the Our Father.

I don't have the corresponding workbook, but I don't really know that it's necessary. All the lessons are on the CD and if I need to know how to spell a word, I can just Google it.

(Some reviewers seem put off by the southern accent of the narrator, but honestly I barely noticed -- and I'm about as northern as you get. It only becomes obvious a couple of times, and even then it's not that heavy. So if you're considering this, I encourage you not to bypass it simply on these grounds.)

Our goal is to do this a couple times a week.

I don't have the corresponding workbook, but I don't really know that it's necessary. All the lessons are on the CD and if I need to know how to spell a word, I can just Google it.

(Some reviewers seem put off by the southern accent of the narrator, but honestly I barely noticed -- and I'm about as northern as you get. It only becomes obvious a couple of times, and even then it's not that heavy. So if you're considering this, I encourage you not to bypass it simply on these grounds.)

Our goal is to do this a couple times a week.

I don't do anything specific for social studies aside from what we learn through Connecting With History and the books we read.

But one thing we all enjoy are these short videos about families from other countries. Each video features a rural and urban family from a particular country and describes how they live from the point of view of the child.

We have a lot of interesting discussions afterward about how other people live around the world. It's especially eye-opening for my children, I think, because almost all of the families -- regardless of country of origin -- live in poorer material circumstances than we do in the U.S. It's important to me that my children understand this and see that even though these children rarely have toys, eat very basic and mundane meals, and at times literally have dirt floors...they are happy, energetic and content individuals.

Note: You may have noticed I don't have anything for Science. I am not formally teaching science this year, though I will be checking out science books from the library on a regular basis for us to read and discuss together. I also have a book of scientific experiments, Janice VanCleave's Big Book of Play and Find Out Science Projects

Kindergarten Plans

My son is 4 1/2 and technically would only be in preschool or "K4." But since I have the luxury of teaching him at his actual skill level, we are doing kindergarten or "K5" work this year. (He is so adept with numbers that I project we'll be moving into 1st grade math this winter.)

Math

- Mathematics K for Young Catholics by Seton Press

This is such a neat math book! The content is solid, and there is Catholic artwork peppered throughout the pages.

Handwriting

We're still working on pencil-holding skills and so this reusable printing workbook is perfect for my boy. It helps him to practice forming letters and become familiar with the lowercase versions.

There is also connect the dot, which is always fun!

There is also connect the dot, which is always fun!

For reading I'll be starting him on The Ordinary Parent's Guide to Teaching Reading soon. He already recognizes several short words and is just starting to show interest in sounding out letters, so it is a good time to begin.

soon. He already recognizes several short words and is just starting to show interest in sounding out letters, so it is a good time to begin.

I also have been printing off free worksheets for him from School Sparks. He thinks they are awesome.

I also have been printing off free worksheets for him from School Sparks. He thinks they are awesome.

Besides the above, there is no other "formal" schooling I'm doing with him. His interests right now are mainly in building Legos and Snap Circuits , which is fine with me. :)

, which is fine with me. :)

If you homeschool, what are you doing this year? Feel free to share your blog post here if you have one!